Springfield – Governor Bruce Rauner released his 2015 federal and state 1040’s, reflecting income and tax rates, while detailing the Rauner family’s charitable and community giving last year.

In 2015, the Rauners paid more than $50 million in federal and state taxes on federal taxable income of $176.7 million and state taxable income of $188.2 million for a total effective tax rate on income of more than 26%. Their federal effective tax rate on income was 24.5%.

In addition, the Rauners and their family foundation made charitable contributions totaling more than $11.6 million.

Rauner 2015 Tax Summary:

Income on Federal Return: $188.2 million

Adjusted Gross Income on Federal Return: $187.6 million

Taxable Income on Federal Return: $176.7 million

Federal Income Taxes Paid: $43.3 million

Federal Effective Tax Rate on Taxable Income: 24.5%

Federal Effective Tax Rate on Adjusted Gross Income: 23.1%

Illinois Taxable Income on State Return: $188.2 million

Illinois Income Taxes Paid: $6.9 million

(Governor's Office)

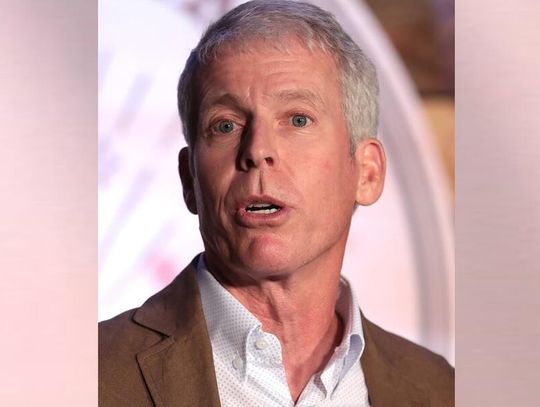

Caption: Bruce Rauner Photo: Dariusz Lachowski

Reklama